Identities are your customers, or more specifically, the details about your customers. Every transaction is initiated by an Identity, but how you treat that information is determined by your regional requirements. Some localities require every detail about your customers be tracked, some jurisdictions require no details at all. It’s up to you to know the laws that apply in your individual case.

The Identity information logging by CAS has been determined to satisfy all currently known requirements - but you’ll have to acquire that information by first setting up your AML/KYC settings.

See: AML/KYC Settings

OFAC (and other) watchlists are automatically checked when a new Identity attempts registration. You can eliminate any specific (or all) lists from these automatic checks. Contact Support for specific information on implementing that procedure.

Identities are quickly viewable by clicking on the Identity listed in the Transaction log.

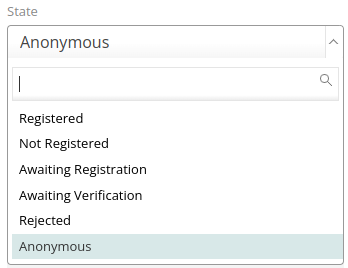

Identity State Types

The possible classes of Identities are determined by your AML/KYC Settings.

If your settings only permit Anonymous, then Registered and Not Registered Identities won’t be able to use your BATM. If you only permit Registered identities, then Identities marked as Not Registered or Anonymous won’t be able to transact.

Be careful with Identity Class assignment.

Anonymous: no details are collected about these customers. All anonymous customers are grouped together as one single entity when considering transaction limits.

Awaiting Registration: your customer has initiated a transaction that requires registration. You must authorize them to proceed.

Awaiting Verification: your customer has been registered, but it’s “on hold” while the documents are further verified.

Not Registered: the customer is not anonymous, is approved for transactions, but isn’t permitted the higher transaction levels offered to Registered customers.

Registered: the customer is fully authorized.

Rejected: the customer has been found wanting. No transactions will be permitted.

Identities should be processed, reviewed, and approved to meet your local AML/KYC requirements.

Retain local legal counsel to advise you on your specific jurisdictional requirements.

General Bytes CANNOT and WILL NOT advise you on your local AML/KYC requirements. As an Operator, you must recruit suitable legal counsel to ensure your compliance!

Create, test, and select a notification policy for your terminal. If a customer registers, you won't be automatically notified unless you specifically create and activate a policy!

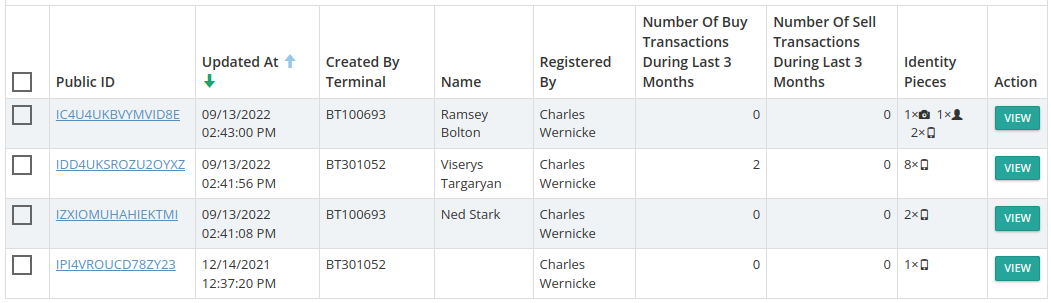

Identity List

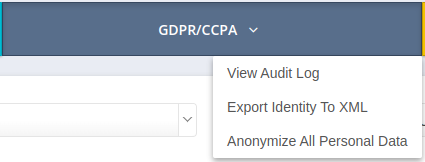

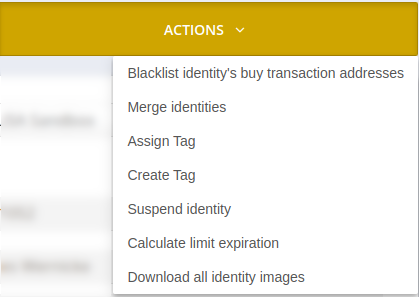

Identity Details

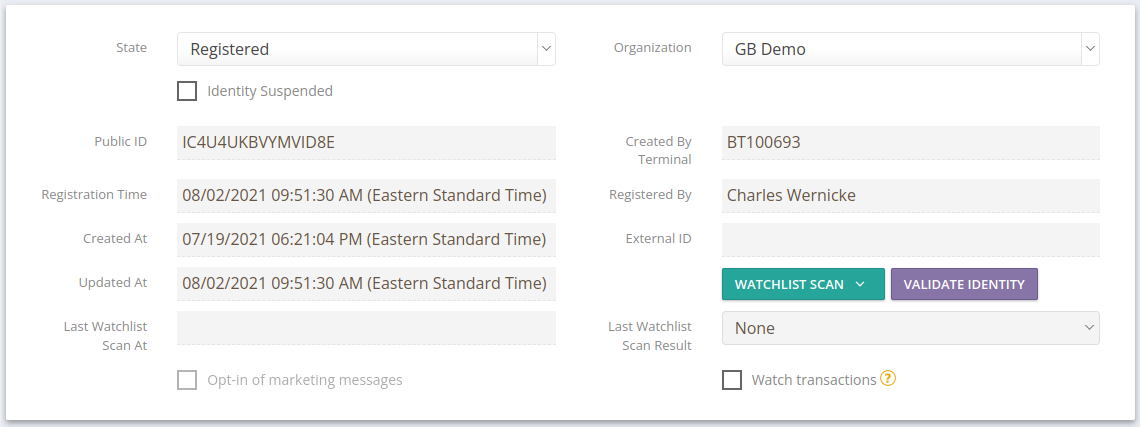

Who, What, When

Your BATM customers will have their supporting documents scanned (if applicable) and their data stored in this area.

State: | The current class of the Identity. Change as desired. |

Organization: | The Organization that “owns” the Identity. |

Identity Suspended: | Temporarily suspends the identity from transacting on the machine - for example when the identity is under investigation. |

Public ID: | A pseudo-random ID used as a common reference for the Identity. |

Created by Terminal: | the Terminal the customer was at when signing up. |

Created At: | the date and time the Identity was added to the CAS database. |

Organization: | the Organization this Identity belongs to. |

Updated At: | the last update date & time. |

External ID: | used with extensions & external identifiers. See: GitHub |

Last Watchlist Scan At: | the most recent Watchlist scan date & time. |

Last Watchlist Scan Result: | the most recent Watchlist scan result. |

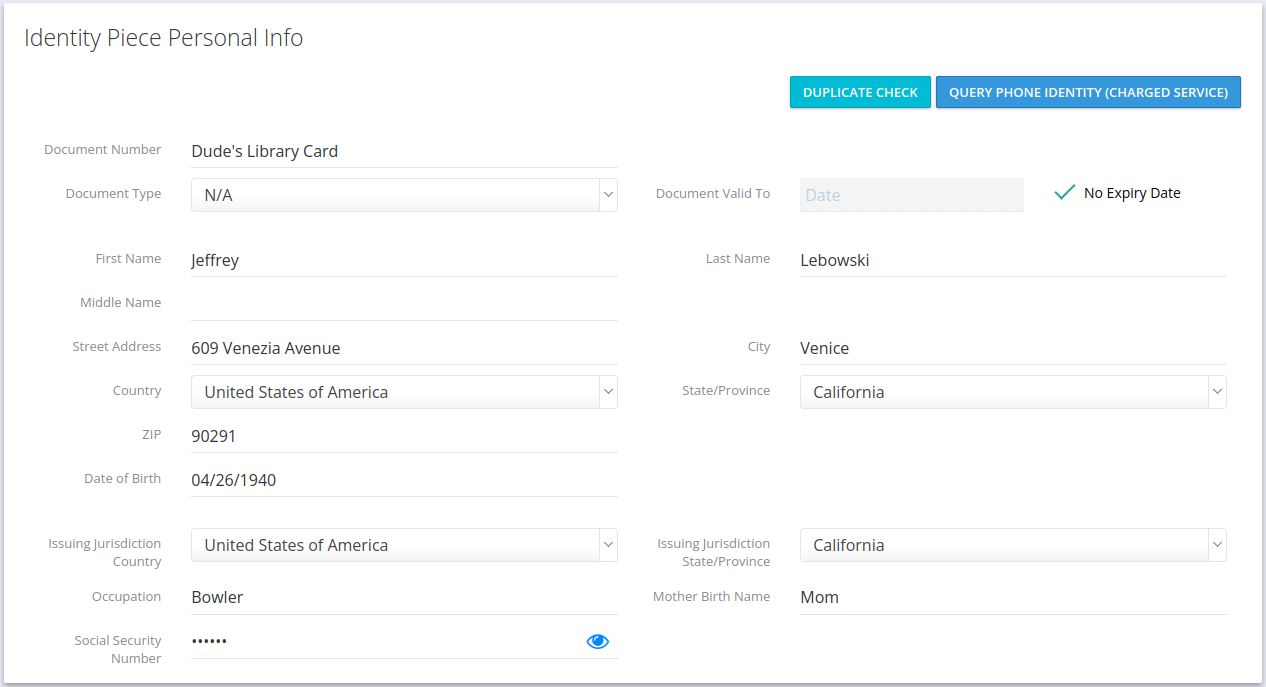

Identity Piece Personal Info

Personal Info should reflect the contents of the identifying document whose “Number” is required to verify the Identity’s identity. All info is optional, and may not be required for every Organization.

“Document Valid To” should be set accurately where possible. See: Document Expiration

Supporting Info

Cell phone numbers used for registration/authorization are listed here. | |

All documents submitted are located under this tab. | |

Any selfies collected are found here. |

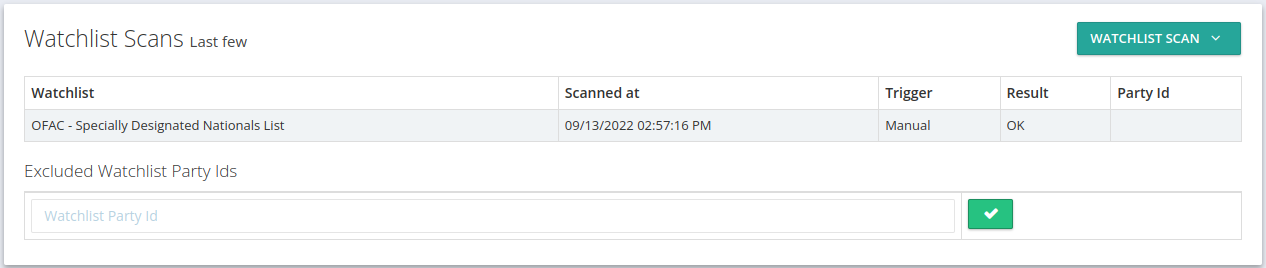

Watchlist Scans

Watchlist scans are automatic (by default). Manual scans may be performed on demand.

All identity watch lists (sanction lists) are re-downloaded by CAS every 24 hours.

Analytics

Statistics provided for quick analysis here. You may also look at all transactions by clicking the TRANSACTIONS button (at the top of the page).

Limits

Remaining limits for this customer will be displayed on their “Identity” profile. Use this data to help identify limit rejections during a transaction. Each implemented limit will be displayed.

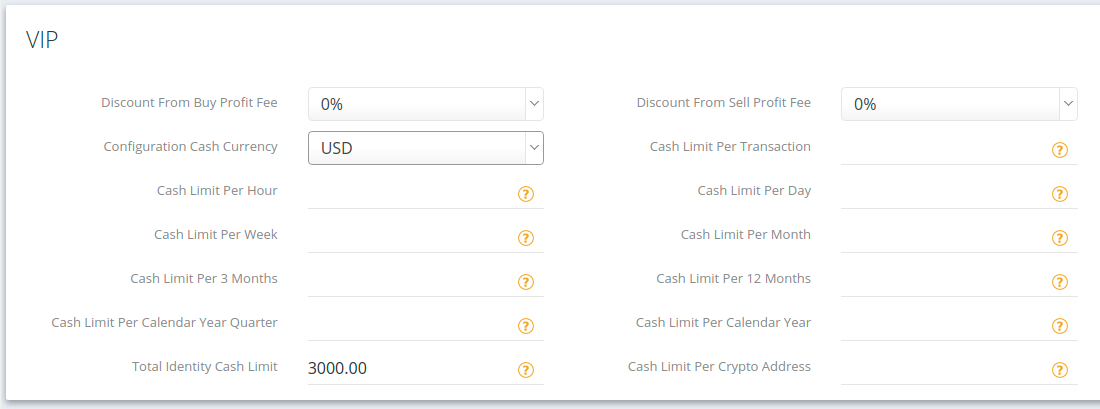

VIP

Use these options to grant any person additional “VIP” limits. You may adjust the limits for this person as you see fit, and/or apply automatic discounts.

To adjust your default limit amounts, see: AML / KYC Settings

The “week” is: US and GB: Sun-Sat, everywhere else: Mon-Sun

Any VIP limits supersede normally applicable limits, however every limit that is defined in “normal” limits (e.g. REGISTERED) should also be defined in the VIP section, or they won’t be applied.

Example:

Period | Normal REGISTERED | VIP | Resulting Limit |

|---|---|---|---|

Cash Limit Per Day | 2000 | 3000 | 3000/day |

Cash Limit Per Week | 6000 | 6000/wk | |

Cash Limit Per Month | 10000 | 10000/mo |

In this case, the Identity would only enjoy the “per Day” increase in his/her limits. The remaining limits for non-VIP would be applied to the transaction.

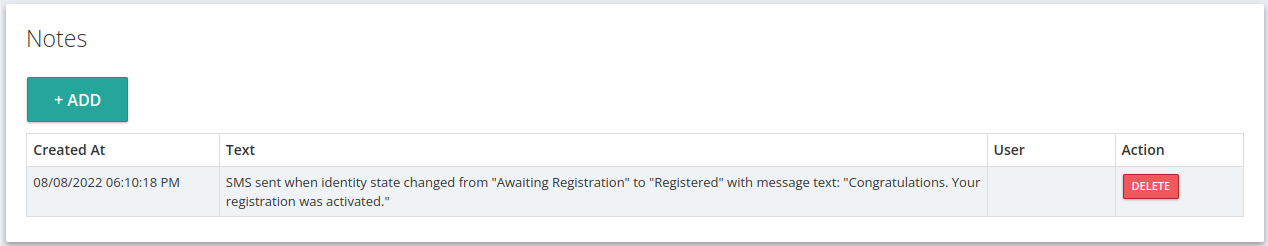

Notes

Save any notes about this Identity and/or approvals/rejections.

Save it!

SUBMIT & CLOSE returns you to the Identity list.