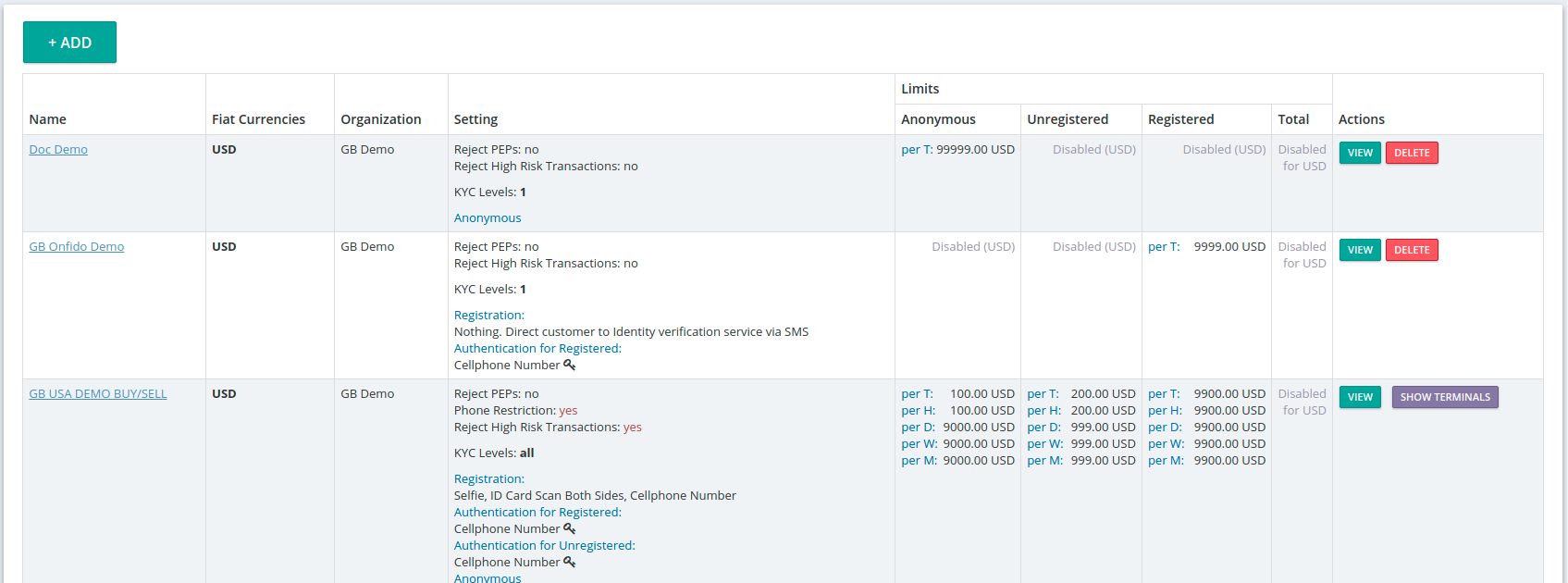

+ADD a new AML/KYC Setting

VIEW the AML/KYC policy

DELETE the AML/KYC policy

will be hidden if the policy is used by any Terminals

Your AML/KYC settings are created and configured here. One setting may be applied to all Terminals, or they may be individually configured, or anywhere in-between.

AML/KYC may be the most important aspect of your business, and it’s very important that you configure your system to comply with your regional laws. SEEK LEGAL COUNSEL! |

General Bytes cannot, and will not, provide advice on your legal requirements. We are a global organization in a very fluid legal environment; we do not pretend to be legal experts or in any way qualified to answer questions that may potentially lead to violations of the law. |

Registrations may be automated: |

The AML/KYC dashboard displays a concise summary of your system-wide AML/KYC settings.

| +ADD a new AML/KYC Setting |

| VIEW the AML/KYC policy |

| DELETE the AML/KYC policy

|

| Displays the Terminals using this Policy. |

Note: OFAC screening is forced (by default) & automatic. For details, see: Identities

Note: OFAC screening is forced (by default) & automatic. For details, see: Identities

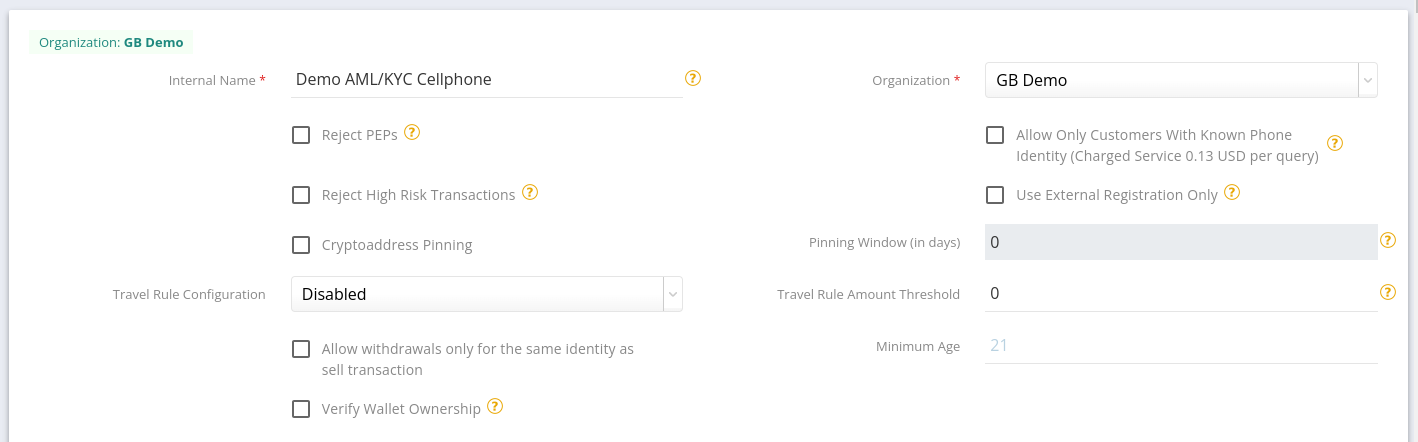

Internal Name*: | describe the setting, i.e. “New York KYC Policy”. |

Organization*: | (admin only) assigns this policy to a specific Organization. |

Reject PEPs: | PEPs (Politically Exposed People) must (by regional law) identify themselves during financial transactions. Enabling this option rejects those customers that are determined to be PEPs. |

Allow Only Customers With Known Phone Identity | This option prevents Unregistered customers with forbidden phone number types from attempting to use your BATMs (and this policy).

|

Reject High Risk Transactions: | High risk transactions are those determined by a 3rd party after a target wallet address (BUY) or a sending address (SELL) is used. When enabled, transactions that are identified as “high risk” will be disabled.

|

Use External Registration Only: | An external system will be used to search for identities, otherwise the internal system will be used for identifying. This option should be enabled only if you use the instruction "Nothing, Go To Website" (see below). |

Cryptoaddress Pinning | After being used by an Identity, a crypto-address will become exclusive to that Identity (for the “X” days specified in the Pinning Window).

|

Pinning Window (in days) | See: Cryptoaddress Pinning (above). |

Travel Rule Configurationthe “Travel” rule requires all financial institutions to pass on certain information to the next financial institution, in certain funds transmittals involving more than one financial institution. | Setting is ignored - unless configured in Organization settings. Options:

“unknown” = wallet owner unidentifiable by CipherTrace. “unknown” = wallet owner unidentifiable by CipherTrace. |

Travel Rule Amount Threshold | Transactions above this amount (inclusive, in Default Fiat Currency configured below) will be submitted to the configured Travel Rule Provider. Lesser amounts will be ignored.

|

Allow withdrawals only for the same identity as sell transaction | When enabled/set, a SELL transaction WITHDRAWAL can only executed by the same Identity that performed the SELL. |

Minimum Age | Set the [integer] minimum age to transact. |

Verify Wallet Ownership | Enabled: prompts a user to confirm on the BATM that the wallet used - belongs to the user. Configure the prompt using the Custom String: |

One (or more) need to be enabled/selected to define your sale limits. The limits control how the approval process is applied (if applied at all).

VIP limits may also be used for individuals to permit larger transaction sizes and discounts.

See: Identities: VIP

If AML/KYC is not implemented, use Anonymous Limits to restrict individual transaction amounts.

The “Cash Limit Per Transaction” amount here must be less than the Unregistered limit.

Adjust the button text (if desired): https://generalbytes.atlassian.net/l/cp/ViSD5Eep

Unregistered Customers have not completely satisfied (or do not require) KYC verification.

The “Cash Limit Per Transaction” amount here must be higher than the Anonymous limit, and

the “Cash Limit Per Transaction” amount here must be less than the Registered limit.

Adjust the button text (if desired): https://generalbytes.atlassian.net/l/cp/ViSD5Eep

Registered Customers have satisfied your KYC requirements and can purchase up the limits set in this section.

The “Cash Limit Per Transaction” amount here must be higher than the Unregistered limit, and

the “Cash Limit Per Transaction” amount here must be less than the Premium limit.

Adjust the button text (if desired): https://generalbytes.atlassian.net/l/cp/ViSD5Eep

Premium Customers are preferred customers with the highest limits. If implemented, these amounts must exceed all others.

The “Cash Limit Per Transaction” amount here must be higher than the Registered limit.

No button is displayed on the BATM screen for this tier - customers using this tier are “Registered” but enjoy the higher limits associated with this tier.

Hide ____ tier button on BUY terminal screen | When checked/enabled, the limit will not be available to the user at the BATM for BUY. If all 3 tiers for BUY are hidden, BUY will still be visible - but Choose Limit screen will be empty! |

Hide ____ tier button on SELL terminal screen | When checked/enabled, the limit will not be available to the user at the BATM for SELL. If all 3 tiers for SELL are hidden, SELL will still be visible - but Choose Limit screen will be empty! |

Enable cash payments | When checked, cash sales can use this limit. Default = enabled. |

Enable card payments | When checked, card payments can use this limit.

|

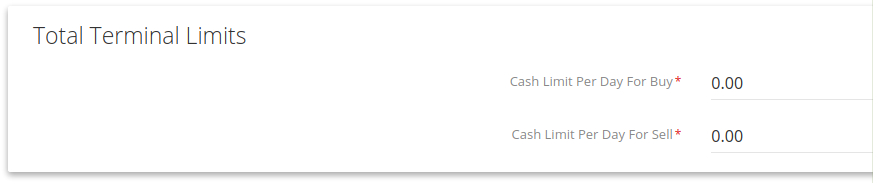

Restrict aggregate transactions to specific amounts, or leave it at zero for no restrictions. This limit prevents the BATM from running out of fiat (and being out of service), or exceeding safe amounts in the cashbox.

Limits available:

Cash Limit Per Transaction* must be NON-ZERO!

Cash Limit Per Hour*

Cash Limit Per Day*

Cash Limit Per Week* (US and GB: Sun-Sat, everywhere else: Mon-Sun)

Cash Limit Per Month* (All transactions between right now and right now minus 1 month. Ie. for right now being 28.2.2023 02:00:00 the result would be: 28.2.2023 02:00:00 - 1 month = 28.1.2023 02:00:00. All transactions between 28.2.2023 02:00:00 and 28.1.2023 02:00:00 28 will be calculated into the limit)

Cash Limit Per 3 Months*

Cash Limit Per 12 Months*

Cash Limit Per Calendar Year Quarter*

Cash Limit Per Calendar Year*

Cash Limit Per Day And Crypto Address*

Total Cash Limit Per Crypto Address*

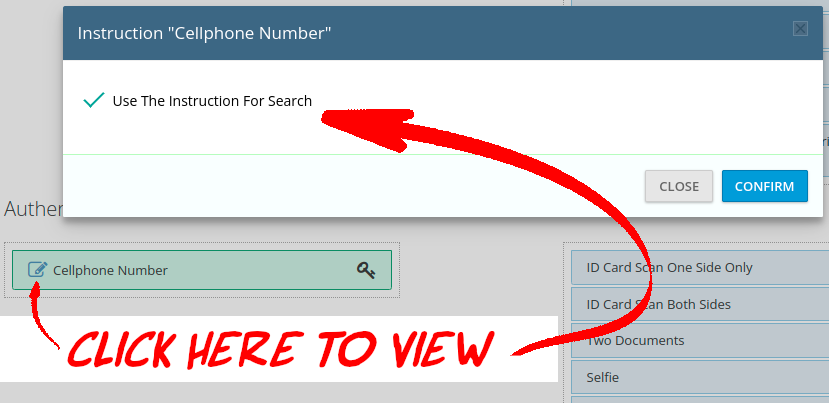

Drag and Drop verification methods from the list on the right, to the appropriate section. Items will be requested in the order they are placed.

Registration items are required to comply with your policies.

Authentication items are required prior to a transaction to prove a customer’s identity.

Items with a checkbox may be configured further (click on the checkbox). |

Set a key for the primary authentication method!

|

An “umbrella” is an optional item that will only be requested if missing. |

These settings are useful for preventing cash outages or excessive cash onsite.

Cash Limit Per Day For Buy*: set the maximum BUY cash amount per BATM.

Cash Limit Per Day For Sell*: set the maximum SELL cash amount per BATM.